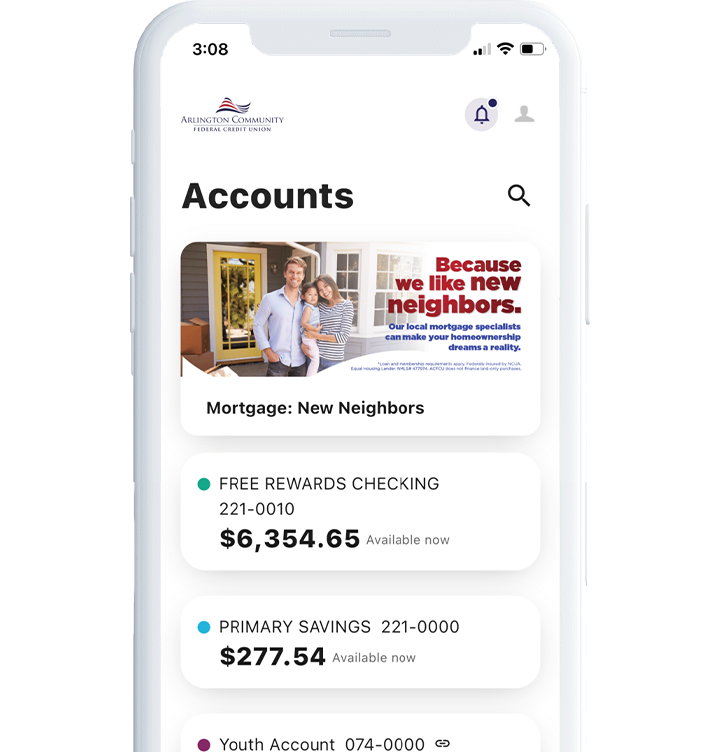

When you chose to bank with Arlington Community Federal Credit Union, you didn’t just choose a financial institution, you joined a community. Whether you’re managing your personal or business finances (or both!), we’re here to make it as easy as possible. That’s why we’ve created this resource to answer any questions you may have, from how to sign up for online banking to how to earn Free Rewards Checking rewards.

Let’s get started. Go to Manage My Personal Account or Manage My Business Account to find the information you need. Just remember, if you have any questions or need help, we’re just a call, email, or branch visit away!

Manage My Personal Account

-

Enroll in Mobile and Online Banking

Enjoy the freedom and convenience of anytime, anywhere banking, at home or on the go.

1. You’ll need:

- Your ACFCU member number

- Your social security number

- At least Two of the following:

– Date of birth

– Email address on file with ACFCU

– Zip code

2. Click the Login box on the top menu of the ACFCU website

3. Select Register, then select Individual

4. Read carefully and check the I Agree box

5. Enter requested information carefully

6. Follow the rest of the prompts to complete the process

-

Setting Up Notifications

You can use the Mobile App or Online Banking to set up alerts for information such as security, account updates, transfer information, and budget and savings goals.

Online Banking

- In the left-side navigation bar, click “More…” and select “Widget Options”

- Direct to the “Notifications” tab and browse the alert options. Select the options that you would like to enable

- Click the settings icon to turn on or off the alert and select how you would like to receive the alerts

- If text messages are not included as an option, you’ll need to go to the “Contact” tab at the top of the page and click the pen icon to the right of your mobile number. Check the box for “I would like to receive SMS text messages to this number” and complete the steps to verify your mobile phone.

Mobile Banking

- For iPhone: In the navigation menu, select “More” and then open the drop-down option “Others.” Under “Others” select “Settings”

- For Android: In the navigation menu, select “Settings”

- Select “Notifications” to browse the alert options. Select the options that you would like to enable

- If text messages are not included as an option, you’ll need to go back to “Settings” and select the “Contact” option. Click your “Mobile” phone number option and select “Enable SMS text messages.”

Card Management

Log into the Mobile App or Online Banking and select the Card Management widget for additional card control options.

- Block and unblock cards when needed

- Set text or email alerts based on dollar amount, type of merchant, and transaction type1

- Block international transactions

- Block transactions by type or merchant and transaction type

- Set dollar amount limits on signature, PIN, and ATM transactions

- For debit cards, report a card lost, stolen, or damaged

Note: You will receive account notifications after transactions are posted to your account. Transactions that are pending will not trigger a notification.

-

Enroll in e-Statements

Ready to reduce your carbon footprint and have the power to access your current or previous statements whenever, and wherever you want? We make it simple:

1. Log in to your online banking account from your computer and go to the eDocs widget

2. Click on Overview

3. Click on the gear wheel

4. Select subscribe

For step-by-step visual instructions, click here.

-

Transfer Money

Transfer money between ACFCU accounts

1. Log in to your ACFCU online banking account

2. Navigate to the Transfers widget and select the Classic Transfer tab

3. For first-time transfers, select the Transfer to Another Arlington Community Federal Credit Union Member (desktop) or Internal Transfer (mobile)

4. Enter the last name of the member or the business name

5. Enter either the account number, phone number, or email the member has on file with ACFCU

6. Select Share or Loan

7. Enter the share or loan ID

8. Name the account and save

9. Now you’re ready to move that money

-

Transfer money from your ACFCU account(s) to an external account

You can transfer between Arlington and/or external accounts for free (subject to a fee for insufficient funds) by following these easy steps:

1. You’ll need:

- The routing number of the other financial institution

- Your account type and number

- Access to your ACFCU online and/or mobile banking

2. Follow the instructions on our step-by-step ACH Origination Setup guide.

- Same-day transfers before 2 p.m. (EST) on valid business days, otherwise it will appear on the next business day

- Each transfer to or from your savings account will count toward monthly transaction limits

- Cancel pending transfers under the Scheduled Transfers feature

-

Sign Up for Direct Deposit

Fun fact: Arlington County, Virginia Hospital Center and Arlington Public Schools employees receive their pay a day early with direct deposit!

1. You’ll need:

- ACFCU’s Routing Number: 256078404

- The 13-digit number of the account you want the money deposited in to. For checking accounts, this number is located on the bottom of your ACFCU checks. For all accounts, you can locate this number in your online banking account under account details.

2. Complete the Direct Deposit form you received when you opened your membership. If you no longer have the form, simply contact us or visit your local branch for a replacement.

-

Receive Automatic Fraud Alerts

ACFCU has an enhanced fraud prevention system for Visa® Debit and Credit Card accounts. Cardholders are automatically enrolled and are alerted when suspicious transactions occur.

Card Management

Log into the Mobile App or Online Banking and select the Card Management widget for additional card control options.

- Block and unblock cards when needed

- Set text or email alerts based on dollar amount, type of merchant, and transaction type1

- Block international transactions

- Block transactions by type or merchant and transaction type

- Set dollar amount limits on signature, PIN, and ATM transactions

- For debit cards, report a card lost, stolen, or damaged

-

Earn Rewards with a Free Rewards Checking Account

- Qualifying for Free Rewards Checking is easy! Simply:

– Make 25 swipe-and-sign, PIN, or debit Bill Pay transactions each month

– Receive in e-Statements

– Receive $500 in ACH deposits into your Free Rewards Checking Account

The Fine Print

*Cash back is calculated based on the total dollar amount of qualifying debit card transactions. Account will not be dividend bearing. 1% cash back on first $1,000 in transactions. Maximum cash back is $10. For minimum requirements to be met, actions must be performed and must clear/post to the account during the qualification period. Transactions may take one or more banking days from the date the transaction was made to post and settle against your account. Swipe & Sign, PIN, and Debit Bill Pay transactions must have cleared account by the end of the month. Standard fees will apply such as an account that has been inactive for longer than 12 months. No overdraft fees for debit card transactions that overdraw by less than $30. This only applies to debit card transactions. ACH transactions do not have the $30 grace before a fee is charged. Overdraft fees must be repaid within 45 days. Courtesy Pay will not be paid if Courtesy Pay is disabled and the transaction is declined. In those cases, an NSF fee will be charged. Courtesy Pay covers the following types of transactions: checks, ACH and other transactions mae using a checking account, automatic bill payments, recurring transactions set up using your debit card, ATM transactions, everyday debit card transactions, and Point of Sale (POS) transactions. ATM transactions, everyday debit card transactions, and Point of Sale (POS) transactions require separate opt-in.

1Up to $10 of ATM fees reversed if reward criteria is met.

2This only applies to debit card transactions. ACH transactions do not have the $30 grace before a fee is charged.

Membership required. Federally insured by NCUA.

- Qualifying for Free Rewards Checking is easy! Simply:

-

Activate Your Visa® Debit Card

- Your Visa® debit card should arrive within five to seven business days from when your checking account was opened.

- Call 866-985-2273 to activate your card and set or change your PIN.

-

Set Up Apple Pay and Other Digital Wallets

The Fine Print

Apple, the Apple logo, iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. Data charges may apply. -

Order Checks

- Your first check order, orders that contain address or name changes, and orders for business members must be placed by an ACFCU member service representative. Call us at 703-526-0200 x4

- For all other check orders, call 703-526-0200 x4, visit your local branch, or place an order via online banking

- Costs vary depending on the kind of checks you choose and the shipping costs

Manage My Business Account

-

Enroll in Mobile and Online Banking

Streamline your business banking process and bank when, and where, you want, from the office, home, or on the go.

1. You’ll need:

- Your ACFCU business member number

- The business’ tax identification number

- At least Two of the following:

– The business’ start date

– The email address on file with ACFCU

– The business’ zip code

2. Click the Login box on the top menu of the ACFCU website

3. Select Register, then select Business

4. Read carefully and check the I Agree box

5. Enter requested information carefully

6. Follow the rest of the prompts to complete the process

-

Enroll in e-Statements

Reduce your business’ carbon footprint and easily access current and previous statements in one place.

1. Log in to your online banking account from your computer

2. Select the eDocs widget (if you don’t see eDocs, select More on the bottom of the left-hand side menu)

3. Subscribe

4. Read carefully, check the Agree box and enter the five-digit code located in the PDF

5. You’re now enrolled in e-Statements!

-

Transfer Money

Transfer money between ACFCU accounts

1. Log in to your ACFCU online banking account

2. Navigate to the Transfers widget and select the Classic Transfer tab

3. For first-time transfers, select the Transfer to Another Arlington Community Federal Credit Union Member (desktop) or Internal Transfer (mobile)

4. Enter the last name of the member or the business name

5. Enter either the account number, phone number, or email the member has on file with ACFCU

6. Select Share or Loan

7. Enter the share or loan ID

8. Name the account and save

9. You’re now optimized to transfer funds

-

Transfer Money from Your ACFCU Account(s) to an External Account

You can transfer between Arlington and/or external accounts for free (subject to a fee for insufficient funds) by following these easy steps:

1. You’ll need:

- The routing number of the other financial institution

- Your account type and number

- Access to your ACFCU online and/or mobile banking

The Fine Print

Transfers initiated before 2pm on valid business days will be processed that business day. Each transfer from your savings account will count toward your monthly transaction limits Pending transfers can be cancelled under the Schedule Transfers feature in online banking

-

Receive Automatic Fraud Alerts

ACFCU has an enhanced fraud prevention system for Visa® Debit and Credit Card accounts. Cardholders are automatically enrolled and are alerted when suspicious transactions occur.

-

Earn Rewards with Your Free Business Rewards Checking Account

Your Free Business Rewards Checking account rewards your everyday banking 1% cash back* on first $1,000 in transactions.

Qualifying is simple!

- Make 25 swipe-and-sign, PIN, or debit Bill Pay transactions each month

- Receive e-Statements

- Receive $500 in ACH deposits into your Free Rewards Checking Account

The Fine Print

*Cash back is calculated based on the total dollar amount of qualifying debit card transactions. Account will not be dividend bearing. 1% cash back on first $1,000 in transactions. Maximum cash back is $10. For minimum requirements to be met, actions must be performed and must clear/post to the account during the qualification period. Transactions may take one or more banking days from the date the transaction was made to post and settle against your account. Swipe & Sign, PIN, and Debit Bill Pay transactions must have cleared account by the end of the month. Standard fees will apply such as an account that has been inactive for longer than 12 months. No ofterdraft fees for debit card transactions that overdraw by less than $30. This only applies to debit card transactions. ACH transactions do not have the $30 grace before a fee is charged. Overdraft fees must be repaid within 45 days. Courtesy Pay will not be paid if Courtesy Pay is disabled and the transaction is declined. In those cases an NSF fee will be charged. Courtesy Pay covers the following types of transactions: checks, ACH and other transactions mae using a checking account, automatic bill payments, recurring transactions set up using your debit card, ATM transactions, everyday debit card transactions, Point of Sale (POS) transactions. ATM transactions, everyday debit card transactions, and Point of Sale (POS) transactions require separate opt-in.

1Up to $10 of ATM fees reversed if reward criteria is met.

2Carrier rates and fees may apply.

Membership required. Federally insured by NCUA.

-

Activate Your Visa® Business Debit Card

- Your Visa® debit card should arrive within five to seven business days from when your checking account was opened.

- Call 866-985-2273 to activate your card and set or change your PIN

-

Set Up Apple Pay and Other Digital Wallets

The Fine Print

Apple, the Apple logo, iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. Data charges may apply. -

Order Checks

- Your first check order (and any subsequent orders after a business name or address change) must be placed by ACFCU for security purposes. Email us at business@arlingtoncu.org.

- To reorder checks, call 703-526-0200 x4 visit your local branch, or place the order via online banking

- Costs vary depending on the kind of checks you choose and the shipping costs

Why Choose Arlington

As a full-service credit union, we’re a cooperative of members like you who know that by coming together, we can all benefit in our financial journey.

Financial Empowerment

We’re here to help our members—and neighbors—meet their financial goals and live their best lives.

Rewarding Experience

We think there’s nothing more rewarding than serving our members—and believe one good turn deserves another.

Utmost Integrity

We not only meet your financial needs, we commit to being a good neighbor and serving with integrity.

While we do monitor fraudulent or suspicious activity and may proactively contact you about this activity, we will never call and ask for confidential information, such as your entire account number or PIN. Contact us at 703-526-0200 if you have provided confidential information.

*Data and carrier rates may apply.