Free Rewards Checking

Rewards for every step of life’s journey.

We're with you every step of the way.

We’re making it even easier to earn cash back rewards each month. Any debit card transaction will count towards your rewards total – including signature and PIN transactions. Plus, using your debit card for online purchases and payments counts, too!

With free conveniences like mobile banking and check deposits from your smartphone, a surcharge-free ATM network — along with no monthly fees — it’s a checking account that fits your life.

- 1% cash back* on first $1,000 in transactions

- Up to $10 refund in ATM fees1

- No minimum balance requirements

- No monthly service charges

It’s easy to qualify!

- Make 25 swipe-and-sign, PIN, or debit Bill Pay transactions each month

- Receive e-Statements

- Receive $500 in ACH deposits into your Free Rewards Checking Account

Checking That Counts

1% cash back* on first $1,000 in transactions

Up to $10 refund in ATM fees1

No minimum balance requirements and no monthly service charges

Great Checking Conveniences

With Free Rewards Checking you’ll enjoy unlimited check writing plus value-added conveniences that can help you better manage your money.

No monthly service fee

or minimum balance requirement

No overdraft fees

for debit card transactions that overdraw by less than $302

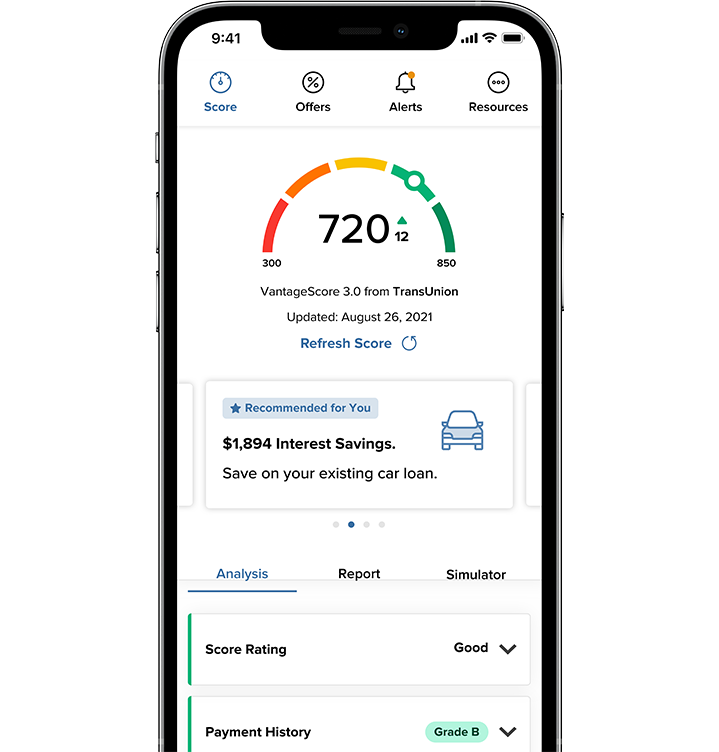

FREE mobile banking for your on-the-go life

with mobile deposit, rewards tracking and more3

Free Visa® debit card

with purchase alerts and card controls found in the Mobile App and Online Banking

Frequently Asked Questions

-

When will I receive my debit card?

Mail: 7-10 business days

In-person: Instant issue option

-

When will I start to earn rewards on my account?

Eligible to start accumulating transactions right away (right after checking account has been opened or converted from a basic checking) and the rewards are applied to the account at the end of the month. If the checking account is closed before the end of the month, then the reward is not applied. Member can use the rewards check-in widget in OLB and mobile app to track their progress.

-

What if I overdraft my account?

Overdrafts won’t impact rewards.

Can overdraft account:

- Courtesy Pay

- Overdraft Transfer

-

Are there any fees or minimum balance requirements?

None for the Free Rewards Checking. Basic Checking may be assessed the express fee if requirements are not met.

-

I’m ready to open a checking account. Where do I begin?

Brand new members: Can open in person at the branch or online.

Existing members: Can open in person at the branch, online, or over the phone at 703.526.0080 x4.

*Cash back is calculated based on the total dollar amount of qualifying debit card transactions. Account does not earn dividends. 1% cash back on first $1,000 in transactions. Maximum cash back is $10. For minimum requirements to be met, actions must be performed and must clear/post to the account during the qualification period. Transactions may take one or more banking days from the date the transaction was made to post and settle against your account. Swipe & Sign, PIN, and Debit Bill Pay transactions must have cleared account by the end of the month. Standard fees will apply such as an account that has been inactive for longer than 12 months.

1Up to $10 of ATM fees reversed if reward criteria is met.

2No overdraft or Courtesy Pay fees for debit card transactions that overdraw by less than $30. This only applies to debit card transactions. ACH transactions do not have the $30 grace before a Courtesy Pay fee is charged. Courtesy Pay fees must be repaid within 45 days. Courtesy Pay will not be paid if Courtesy Pay is disabled, and the transaction is declined. In those cases, an NSF fee will be charged. Courtesy Pay covers the following types of transactions: checks, ACH, and other transactions made using a checking account, automatic bill payments, recurring transactions set up using your debit card, ATM transactions, everyday debit card transactions, and Point of Sale (POS) transactions. ATM transactions, everyday debit card transactions, and Point of Sale (POS) transactions require separate opt-in.

3Data rates may apply.

Membership required. Federally insured by NCUA.