Informationen über die Zweigstellen, einschließlich der Öffnungszeiten der Lobby und der Zufahrtsstraßen, finden Sie unter Kontakt.

Meine Kontodaten & Auszüge

-

Wie kann ich meine Kontaktinformationen aktualisieren und überprüfen?

Es ist einfach und schnell, Ihre Daten zu aktualisieren und zu verifizieren. Folgen Sie diesen einfachen Anweisungen für das Online Banking (Desktop) oder die Mobile App (iOS oder Android).

Mobile App (iOS)

1. Bei der Mobile App anmelden

2. Gehen Sie zu Mehr

3. Zu anderen gehen

4. Gehen Sie zu Einstellungen

5. Gehen Sie zu Kontakt

6. Hinzufügen oder Aktualisieren von Telefonnummern, E-Mail-Adressen und Präferenzen

7. Bestätigen Sie Ihre Telefonnummer, indem Sie die Sicherheitsfragen beantworten oder einen Code aus Ihrer E-Mail eingebenMobile Anwendung (Android)

1. Bei der Mobile App anmelden

2. Rufen Sie das Hamburger-Menü auf (drei Zeilen oben links)

3. Gehen Sie zu Einstellungen

4. Gehen Sie zu Kontakt

5. Hinzufügen oder Aktualisieren von Telefonnummern, E-Mail-Adressen und Präferenzen

6. Bestätigen Sie Ihre Telefonnummer, indem Sie die Sicherheitsfragen beantworten oder einen Code aus Ihrer E-Mail eingebenOnline-Banking

1. Anmeldung beim Online-Banking

2. Gehen Sie zu Einstellungen (oben rechts)

3. Gehen Sie zu Kontakt

4. Hinzufügen oder Aktualisieren von Telefonnummern, E-Mail-Adressen und Präferenzen

5. Bestätigen Sie Ihre Telefonnummer, indem Sie die Sicherheitsfragen beantworten oder einen Code aus Ihrer E-Mail eingeben -

Wie kann ich meine E-Mail- oder Straßenadresse aktualisieren?

- Melden Sie sich bei unserem Handy-Applikation1 oder Onlinebanking

- Klicken Sie auf Einstellungendann Kontakte

- Ändern Sie Ihre persönlichen Daten

-

Wann erhalte ich meinen Kontoauszug?

Sie erhalten monatliche Auszüge, wenn Sie ein aktives Girokonto oder einen Kredit haben. Ansonsten erhalten Sie vierteljährliche Auszüge. Der Abrechnungszyklus läuft vom ersten bis zum letzten Tag des Monats. Wenn Sie für elektronische Kontoauszüge eingeschriebenSie erhalten eine E-Mail, sobald Ihr elektronischer Kontoauszug verfügbar ist.

-

Wie kann ich auf elektronische Kontoauszüge zugreifen?

Sie können Ihre elektronischen Kontoauszüge aufrufen, indem Sie auf die Schaltfläche eDocs Widget im Online-Banking.

-

Wie viele Monate an elektronischen Kontoauszügen werden in meiner Bibliothek für elektronische Kontoauszüge enthalten sein?

Sobald Sie sich für elektronische Kontoauszüge angemeldet haben, werden die elektronischen Kontoauszüge der letzten 24 Monate in Ihrer Bibliothek gespeichert.

-

How do I add my card to my mobile wallet?

Click on your device for instructions to add your card to your mobile wallet.

Mein Geld verwalten

-

Bietet mein Girokonto einen Überziehungsschutz?

Ja. ACFCU kann Überziehungskredite auf zwei verschiedene Arten abdecken:

- Höflichkeitslohn3 - Wenn Sie die Voraussetzungen erfüllen, werden Sie automatisch angemeldet. Sie können sich über das Courtesy Pay Widget in der Mobile App abmelden1 und Online Banking.

- Überziehungsüberweisung - z. B. eine Verbindung zu einem anderen Konto.

Courtesy Pay umfasst die folgenden Arten von Transaktionen:4

- Schecks, ACH und andere Transaktionen, die über ein Girokonto getätigt werden

- Automatische Rechnungszahlungen

- Wiederkehrende Transaktionen, die mit Ihrer Debitkarte durchgeführt werden

- ATM-Transaktionen

- Alltägliche Debitkartentransaktionen

- Point of Sale (POS)-Transaktionen

Außerdem bieten wir einen Freibetrag von $30. Das bedeutet, dass keine Gebühren für Debitkartentransaktionen anfallen, wenn Ihr überzogener Saldo weniger als $30 beträgt.2

Das Kleingedruckte

1Es können Datenraten gelten.

2Dies gilt nur für Debitkartentransaktionen. ACH-Transaktionen haben nicht die Gnade $30, bevor eine Gebühr erhoben wird.

3Für jedes Ereignis wird eine Gebühr von $30 erhoben.

4Transaktionen an Geldautomaten, alltägliche Debitkartentransaktionen und POS-Transaktionen (Point of Sale) erfordern ein separates Opt-in.

5Apple, das Apple-Logo, iPhone und iPad sind Marken von Apple Inc. und in den USA und anderen Ländern eingetragen. App Store ist eine Dienstleistungsmarke von Apple Inc. Android ist eine Marke von Google Inc. Es können Datengebühren anfallen.

-

Wie kann ich automatische Einzahlungen oder Abhebungen für mein ACFCU-Konto bei einer externen Partei einrichten?

Wenn Sie elektronische Zahlungen, Abhebungen oder Einzahlungen auf Ihr Konto von einem Händler oder einem anderen Finanzinstitut vornehmen (z. B. Einzahlungen von Gehaltsabrechnungen oder Zahlungen von Rechnungen von Versorgungsunternehmen), teilen Sie diesem Händler oder Institut Ihre Kontonummer und die ABA-Leitungsnummer des ACFCU mit: 256078404.

-

Wie verwalte ich automatische Einzahlungen oder Abhebungen von meinem ACFCU-Konto?

Mit diesen einfachen Schritten können Sie Überweisungen zwischen Ihrem ACFCU-Konto und externen Konten kostenlos durchführen (bei unzureichender Deckung fällt eine Gebühr an):

1. Das brauchen Sie:

- Die Routingnummer des anderen Finanzinstituts

- Art und Nummer Ihres Kontos

- Zugang zu Ihrem ACFCU Online- und/oder Mobile-Banking

2. Folgen Sie den Anweisungen in unserer Schritt-für-Schritt-Anleitung ACH Origination Setup Anleitung.

- Überweisungen am selben Tag vor 14.00 Uhr (EST) an gültigen Geschäftstagen, andernfalls am nächsten Geschäftstag

- Jede Überweisung auf oder von Ihrem Sparkonto wird auf die monatlichen Transaktionslimits angerechnet.

- Stornieren Sie ausstehende Überweisungen im Rahmen der Funktion Geplante Überweisungen

-

Bieten Sie Überweisungen an?

Ja, um Geld auf Ihr ACFCU-Konto zu überweisen, geben Sie dem anderen Institut einfach die folgenden Anweisungen:

Eingehende Drähte

- Überweisung an: Arlington Community Federal Credit Union, ABA# 256078404

- Gutschrift an: Ihren Namen und Ihre 13-stellige Kontonummer (steht auf der Unterseite Ihrer Schecks oder im Online-Banking)

Abgehende Drähte

- Kann online, persönlich, per Fax oder E-Mail beantragt werden.

-

Wie richte ich elektronische Benachrichtigungen für Darlehenszahlungen ein?

- Anmeldung beim Online-Banking

- Klicken Sie auf Ihren Namen in der oberen rechten Ecke

- Klicken Sie im Dropdown-Menü auf EINSTELLUNGEN

- Klicken Sie auf NOTIFICATIONS

- Klicken Sie unter Konten auf das Symbol EINSTELLUNGEN rechts neben Fälligkeitsdatum der Darlehenszahlung.

- Schieben Sie die Taste auf ON

- Klicken Sie auf SELECT AN ACCOUNT

- Wählen Sie das/die Darlehen und dann die Anzahl der Tage vor und nach dem Fälligkeitsdatum aus, an denen Sie eine Benachrichtigung erhalten möchten.

- SAVE anklicken

- Klicken Sie das Kästchen an, um anzugeben, auf welche Weise Sie die Benachrichtigung erhalten möchten: EMAIL und/oder MOBILE

- Klicken Sie auf ÄNDERUNGEN SPEICHERN

Um einen Alert zu ändern, folgen Sie den obigen Anweisungen.

Um einen Alarm zu löschen, führen Sie die Schritte 1-6 aus und schieben Sie die Taste auf OFF.

-

What are the requirements when creating a username for Online and Mobile Banking?

Usernames must be alphanumeric and between eight and 15 characters. Old usernames cannot be reused.

Vereinbarungen, Gebühren und Vertragsstrafen

-

Wie kann ich die Datenschutzbestimmungen der Arlington Community Federal Credit Union einsehen?

Sie können auf unser Datenschutzbestimmungen jederzeit online.

-

Wie kann ich Geldautomatengebühren vermeiden?

Es gibt drei Möglichkeiten, die Geldautomatengebühren zu vermeiden:

- Verwenden Sie eine gebührenfreie Arlington Gemeinschaft FCU ATM

- Öffnen Sie eine Kostenloses Rewards Girokonto und die monatlichen Voraussetzungen erfüllen, um monatlich bis zu $10 an ATM-Gebühren erstattet zu bekommen

- Verwenden Sie eine von fast 30.000 Geldautomaten im Co-Op-Netzwerk

-

Wie hoch sind Ihre Gebühren und wann werden sie erhoben?

Falls zutreffend, werden die Gebühren im Laufe des Monats erhoben und erscheinen auf Ihrer regulären Monatsabrechnung. Unser Angebot Persönlich, Gemeinschaft oder Business Gebührentabelle.

-

Wie kann ich die Zahlung der monatlichen $5-Guthabenaufrechterhaltungsgebühr oder Express-Gebühr vermeiden?

Sie können die monatliche Wartungsgebühr auf drei Arten vermeiden:

1. Behalten Sie einen kombinierten Kredit- und Einlagenbetrag von $1.000

2. Verwenden Sie aktiv eine Kostenloses Rewards Girokonto

3. Wir verzichten auf den Beitrag für Mitglieder unter 21 Jahren oder über 55 Jahren

-

Gibt es eine Strafe für die vorzeitige Rückzahlung meines Kredits?

Nein, wir bestrafen Sie nicht für die vorzeitige Rückzahlung von Krediten. Wenn wir in Ihrem Namen Gebühren für den Abschluss des Kredits gezahlt oder einen Cash-Back-Anreiz geboten haben, müssen diese Beträge zurückgezahlt werden, wenn Sie Ihren Kredit innerhalb von 36 Monaten nach Eröffnung des Kredits abschließen. Der geschuldete Betrag wird in den Rückzahlungsbetrag Ihres Kredits eingerechnet.*

Das Kleingedruckte

*Wenn das Darlehen innerhalb von 36 Monaten nach der Eröffnung abbezahlt wird, können die Rückzahlung oder die Abschlusskosten zum abbezahlten Betrag hinzugerechnet werden.

Kostenloses Rewards Girokonto

-

Wann werde ich meine Debitkarte erhalten?

Post: 7-10 Arbeitstage

Persönlich: Sofortige Ausgabeoption

-

Ab wann kann ich auf meinem Konto Prämien verdienen?

Sie können sofort mit dem Sammeln von Transaktionen beginnen (direkt nach der Eröffnung eines Girokontos oder der Umwandlung eines einfachen Girokontos), und die Prämien werden dem Konto am Ende des Monats gutgeschrieben. Wird das Girokonto vor Ende des Monats geschlossen, wird die Prämie nicht gutgeschrieben. Die Mitglieder können das Rewards-Check-in-Widget in der OLB und der mobilen App verwenden, um ihren Fortschritt zu verfolgen.

-

Was passiert, wenn ich mein Konto überziehe?

Überziehungen haben keine Auswirkungen auf die Prämien.

Kann das Konto überziehen:

- Höflichkeitslohn

- Überweisung

-

Gibt es irgendwelche Gebühren oder Mindestguthabenanforderungen?

Keine für das Free Rewards Checking. Bei Basic Checking kann die Expressgebühr erhoben werden, wenn die Voraussetzungen nicht erfüllt sind.

-

Ich bin bereit, ein Girokonto zu eröffnen. Wo soll ich anfangen?

Ganz neue Mitglieder: Kann persönlich in der Filiale oder online eröffnet werden.

Bestehende Mitglieder: Kann persönlich in der Filiale, online oder telefonisch unter folgender Adresse eröffnet werden 703.526.0080 x4.

Persönliche Darlehen

-

What are the requirements to apply for a personal loan?

You must be a member or qualify for membership in ACFCU and your membership must be established before any loan can be issued.

-

How much can I borrow with a personal loan?

We offer personal loans from $1,000 to $50,000, subject to credit and income qualifications.

-

What can a personal loan be used for?

Just about anything! Personal loans are great for consolidating debts or financing a household expenses at a lower interest rate than a credit card.

- What is the process of applying for a personal loan?

-

When will I receive the funds from my personal loan?

Once your application is approved and any supporting documents (such as verification of your income, if needed) have been provided, you can sign your loan documents electronically and have the funds in a matter of hours.

-

What type of collateral do I need to provide for a personal loan?

Personal loans do not require collateral; however, if you do have collateral, like a paid-off vehicle, you may be able to qualify for a larger loan at a lower rate using your collateral.

-

Is there an advantage to paying off my loan faster?

Yes! You are welcome to make larger or additional payments at any time. There is no penalty for paying early and you’ll save money in interest over the life of the loan. Just remember that you have to make each scheduled payment when it is due, even if you previously made a larger payment.

-

Do you offer payment protection?

Yes, we offer convenient and affordable payment protection options that protect you and your loved ones in the event of disability or death of a covered borrower.

Hypotheken und Wohneigentum

-

Was sollte ich tun, bevor ich eine Hypothek beantrage?

Beantragen Sie eine neue Hypothek oder refinanzieren Sie Ihre aktuelle Hypothek? Beziehen Sie sich auf diese praktische Checkliste für den Hypothekenantrag um herauszufinden, welche Formulare Sie benötigen, um das Verfahren voranzutreiben.

-

Wie kann ich die Begriffe besser verstehen?

Sie kennen Ihre Amortisation nicht von Ihrer Rückzahlung? Kein Problem! Unser glossar der hypothekenbegriffe wird alles aufschlüsseln, was Sie wissen müssen, und Ihnen helfen, wie ein Profi zu klingen.

-

Kennen Sie Tipps für Hypothekenanträge?

Wir haben unsere Die 10 besten Tipps für die Beantragung einer Hypothek um Sie zu einem starken Bewerber zu machen, damit Sie Ihr Traumhaus finanzieren können.

-

Wie kann ich den Prozess besser verstehen?

Der Kauf oder die Refinanzierung eines Hauses kann überwältigend und verwirrend sein, aber mit unserem Leitfaden zum Verständnis des HypothekenprozessesDas muss nicht sein.

-

Was sollte ich tun, bevor ich einen Kredit oder eine Kreditlinie für Wohneigentum beantrage?

Bereiten Sie sich darauf vor, Ihren Antrag auf ein Eigenheimdarlehen auszufüllen, indem Sie die Kästchen in unserem Checkliste für den Antrag auf Eigenheimzulage.

-

Wie beantrage ich eine Nachrangigkeitsvereinbarung?

Die Beantragung einer Unterordnung ist einfach: Folgen Sie den Schritten im Anweisungen für die Nachrangigkeitsvereinbarung.

-

Wo finde ich Antworten auf meine Fragen zu Auszahlungen und Abrechnungen von Eigenkapital?

Schnelle Antworten auf alle Ihre dringenden Fragen zu Wohneigentum finden Sie in unserem FAQ Zahlung und Auszüge Leitfaden.

-

Wie kann ich auf meine Kreditlinie zugreifen?

Noch nie war es so einfach zu verstehen, wie man einen Kredit zu Hause in Anspruch nehmen kann wie mit unserem FAQ zum Zugang zur Kreditlinie Leitfaden.

*Dies gilt sowohl für Verbraucher- als auch für Beteiligungsdarlehen.

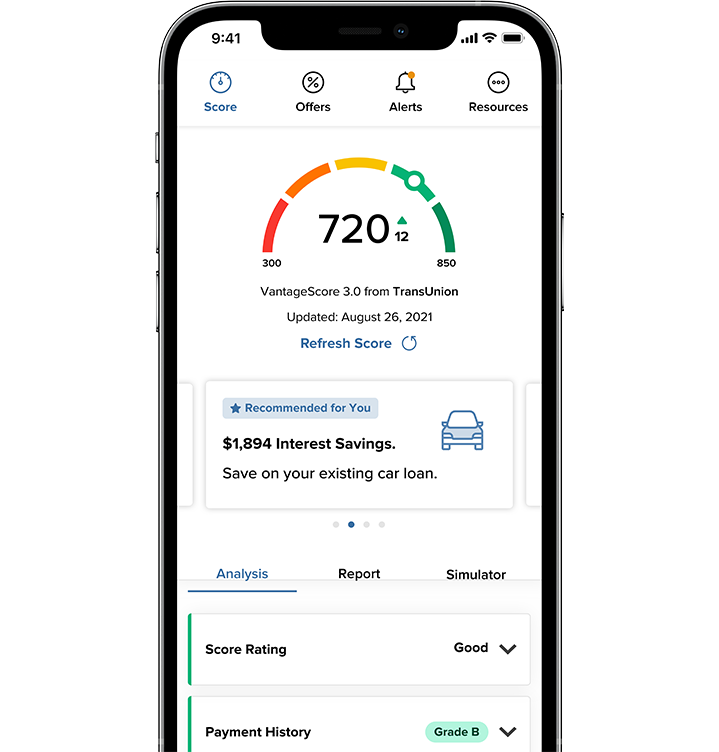

Savvy Money

-

Is Savvy Money free?

Yes! Savvy Money is a free service available in Online Banking and Mobile.

-

Will enrolling or accessing Savvy Money affect my credit and potentially lower my score?

No! Checking credit scores on Credit Score is a “soft inquiry” that does not affect credit score.

-

What scoring model does Savvy Money use?

Vantage 3.0

Please note that Vantage Score and FICO scores may be different and may result in different credit tiers/rates.

-

What bureau does Savvy Money pull credit profiles from?

TransUnion

-

How is my privacy protected through this credit monitoring service?

To enroll, you first must be logged in to our secure online banking or mobile platform. Your credit information is never shared with third parties.

-

Can the credit score in Savvy Money differ from other credit monitoring apps or loan applications?

Yes. Three major credit reporting bureaus—Equifax, Experian, and Transunion—and two scoring models—FICO or VantageScore—determine credit scores. Financial institutions/lenders use different bureaus, as well as scoring models. Over 200 factors of a credit report may be considered when calculating a score, and each model may weigh credit factors differently. Hence, no scoring model is completely identical but should directionally be similar.

-

Why is my credit score different in Credit Score than the score on my loan application?

Savvy Money is a credit monitoring tool we provide to you at no cost to learn more about how your financial decisions impact your credit score. You can expect your score to be different because we consider additional credit factors in your loan application that are not available in this tool that may result in a different score.

Credit monitoring tools like Savvy Money use scoring models like Vantage Score 3.0 to display your credit details. There are additional credit factors we consider when reviewing your loan application by using a FICO scoring model. The use of different scoring models is why you see a difference in your scores.

No scoring models are identical but are directionally the same. If your score goes up based on your credit activity in Savvy Money, you might see an increase in the scores we pull for loan applications as well.

-

What if I see an error on my credit report?

If you find incorrect information in your credit report, contact the company that issued the account or the credit reporting company that issued the report.

There is also more information on how to resolve these types of issues in the FAQ section under Resources.

-

Can I download my credit report in Savvy Money?

Yes! On the Credit Report page, click “Download Report” in the top right corner.

-

When does my status change to inactive in Savvy Money?

If you do not log in to online or mobile banking for 120 days, your Money Savvy will go inactive, and you will be unenrolled. To re-enroll, follow the normal enrollment procedures to regain access to your profile information.

-

Can I unenroll from Savvy Money?

Yes. On the Resources tab, select “Profile Settings”, scroll to the very bottom and select “Deactivate Credit Score Account.” Once unenrolled, you can choose to reenroll at any time through online or mobile banking.

-

Can I receive alerts from Savvy Money?

You can receive credit alerts, monthly notices, and general messages from Credit Score.

-

Can I turn off email notifications from Credit Score?

Yes. You can manage your email notifications by navigating to the Resources Tab, selecting “Profile Settings”, and changing their preferences under Email Notifications. You can also change your subscription settings at the bottom of emails you receive.

-

Who responds to the questions Contact Us option?

Savvy Money will answer general questions related to credit scores and their site. Any specific credit union questions will be redirected to our Digital Banking team.

Business-Kreditkarten

-

Kann ich Überweisungen von meinem Hauptkreditkartenkonto vornehmen?

Nein, die Hauptkreditkarte ist ein Aufbewahrungsort für die Gelder. Um Überweisungen vorzunehmen, müssen Sie auf dem Bildschirm "Überweisungen" die Kreditkarte als "Von"-Konto und dann eine Aktie als "Nach"-Konto auswählen.

-

Was ist ein Geschäftskarteninhaber?

The Business Cardholder has an assigned credit card given to them by the Business Administrator. They cannot request a limit increase, report a card lost or stolen, etc. Any maintenance requests must be submitted by the Guarantor. If you are the guarantor, please contact card holder services at 800-637-7728.

-

Wie reiche ich eine Beschwerde ein?

Nur der Garantiegeber kann eine Anfechtung einreichen. Er muss sich an den Karteninhaber-Service unter 800-637-7728 wenden.

-

Wie reiche ich eine Betrugsanzeige ein?

Nur der Garantiegeber kann einen Betrugsantrag stellen. Er muss sich an den Karteninhaber-Service unter 800-637-7728 wenden.

-

Wie kann ich meine PIN einrichten?

Rufen Sie jetzt PIN an unter 800.631.3197, geben Sie EIN und die Telefonnummer Ihres Unternehmens an.

-

Werde ich meine Geschäftskreditkarte sehen, wenn ich mich mit meinen persönlichen Zugangsdaten anmelde?

Nein, die persönlichen Konten bleiben von den Geschäftskonten getrennt.

-

Wann ist die Fälligkeit meiner Geschäftskreditkarte?

Am 25.th des Folgemonats.

-

Wie kann ich Zahlungen mit meiner Geschäftskreditkarte vornehmen?

- Online-Überweisungen von einem Business Checking-Konto auf die Control Card.

- Senden Sie einen Scheck an den Karteninhaber-Service - die Adresse finden Sie auf dem Kontoauszug.

- Besuchen Sie eine Filiale, um eine Zahlung vorzunehmen.

-

Wie kann ich mich für elektronische Kontoauszüge anmelden?

1. Loggen Sie sich von Ihrem Computer aus in Ihr Online-Banking-Konto ein und gehen Sie auf die Seite eDocs-Widget

2. Klicken Sie auf Übersicht

3. Klicken Sie auf das Abonnements Einstellung Caret: V

4. Klicken Sie auf das Getrieberad

5. Wählen Sie abonnieren!

-

Warum wird auf meiner Kreditkarte ein Saldo von Null angezeigt, obwohl ein Saldo vorhanden ist?

In Ihrer Online-Ansicht können Sie nur Ihre Transaktionen sehen. Der Geschäftsadministrator hat Zugriff auf die gesamte Transaktionshistorie und die Salden für alle Karteninhaber.

-

Wie kann ich eine Gebühr anfechten?

Kontaktieren Sie Ihren Garantiegeber.

-

Wie kann ich eine Ersatzkarte bestellen?

Kontaktieren Sie Ihren Garantiegeber.

-

Wie kann ich meinen Online-Zugang zurücksetzen?

Wenden Sie sich an Ihren Business Administrator, um Ihren Online-Zugang freizuschalten.

Why Remarkable Service

is Right For You

Als Full-Service-Kreditgenossenschaft sind wir eine Genossenschaft von Mitgliedern wie Ihnen, die wissen, dass wir alle auf unserem finanziellen Weg profitieren können, wenn wir zusammenkommen.

Finanzielles Empowerment

Wir sind hier, um unseren Mitgliedern - und Nachbarn - zu helfen, ihre finanziellen Ziele zu erreichen und ihr bestes Leben zu leben.

Belohnende Erfahrung

Wir sind der Meinung, dass es nichts lohnenderes gibt, als unseren Mitgliedern zu dienen - und wir glauben, dass eine gute Tat eine andere verdient.

Äußerste Integrität

Wir erfüllen nicht nur Ihre finanziellen Bedürfnisse, wir verpflichten uns auch, ein guter Nachbar zu sein und mit Integrität zu dienen.